The Township of Langley is in the midst of a development boom, with thousands of new homes and ambitious infrastructure projects reshaping the fast-growing community. But the municipality's ballooning debt load - which has quadrupled to $668 million in just two years - is raising alarm bells about the long-term sustainability of this growth model.

The Langley Chamber of Commerce has described development along the township's 200th Street corridor as "booming," "supercharged," and "exciting." The Willoughby area alone has seen approvals for about 6,000 new homes since 2022, with proposals for thousands more units in the pipeline.

"Langley is no longer a bedroom community, it is a city in and of itself," said Chamber CEO Cory Redekop. "We are excited for the growth, it's great, but we are going to get to a point where we won't be able to do anymore because we don't have the schools for the kids, we don't have the rec centres for the families and we don't have the hospital beds for the patients."

This rapid expansion is straining existing infrastructure. The Langley school district is seeing an influx of about 1,000 new students annually, mostly in Willoughby. Mayor Eric Woodward has expressed concern that "schools are not being built fast enough by the provincial government" to keep pace.To fund new infrastructure and community amenities, the Township council has embarked on an unprecedented borrowing spree. At a December council meeting, staff confirmed that approved borrowing now totals $668 million - up from just $169 million before the 2022 election.

Major projects in the works include a new Brookswood fire hall, ice rinks, park upgrades, road widenings, and a $154.7 million athletic facility. The township is also set to borrow $75 million to purchase unspecified "strategic land."Mayor Woodward and his Contract with Langley slate, which holds a council majority, ran on a platform of rapidly expanding facilities and infrastructure. They argue the debt is necessary to catch up on longstanding shortfalls, particularly in Willoughby where years of frozen development charges led to patchy infrastructure.

"We're dealing with extraordinary situations," Woodward said, citing urgent needs like culvert replacements. He maintains most projects will be funded through future development charges (DCCs) and community amenity contributions (CACs) from developers. "They're funded from revenue and growth sources," he said.

But critics argue this model carries significant risks.

James Hansen, Director of Strong Towns Langley, warns that "using debt to this level is quite a radical change" for a township that has traditionally been fiscally conservative.

"One problem with the debt is there is a fundamental lack of transparency," Hansen said. "Sometimes they specify it as 'debt to be paid back by DCCs (Development Cost Charges) like on 208th's widening. And there are signs that this might work - one approved project on 208th St and 68th Ave will pay a big chunk of this cost if it goes ahead. But in other cases, it's just general debt or from CACs (Community Amenity Contributions). And we don't really know how much growth we're going to see in the future."

Community Amenity Contributions (CACs) are contributions made by developers to provide community benefits as part of a development project. These contributions can take various forms, such as funding for parks, community centers, affordable housing, or other public amenities.

Hansen and other critics argue the township is making a risky bet that rapid growth will continue indefinitely to pay off the mounting debt. If development slows, taxpayers could be left holding the bag for millions in interest payments. At current rates, $500 million in loans would result in $25 million in annual interest costs alone.

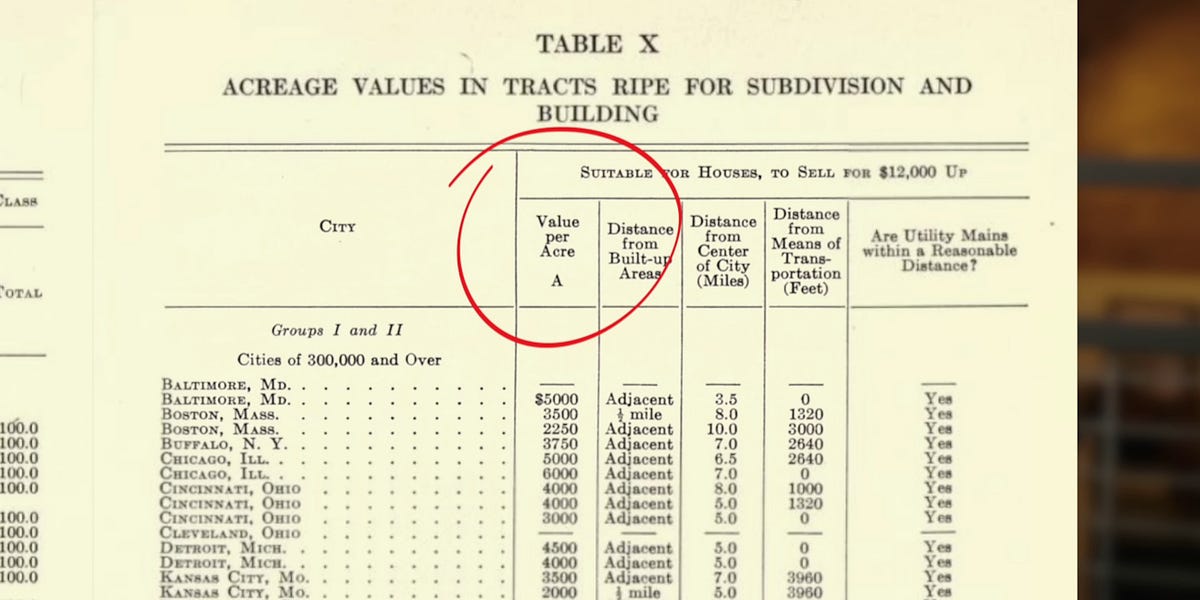

There are also concerns about whether the development charges truly cover long-term infrastructure costs. "The development charges might cover the initial construction, but they don't account for the decades of maintenance, operational costs, and eventual replacement that the Township will be responsible for," Hansen explained.

He points to older suburban areas like Walnut Grove and Murrayville that are now grappling with aging infrastructure and rising maintenance costs. Yet there has been little effort to encourage urban infill or increased density in these areas to boost the tax base.

"Most of the older suburban areas like Walnut Grove and Murrayville are getting expensive to maintain as well due to their aging infrastructure, yet there is no effort to encourage some urban infill/density to increase property tax revenues to offset this," Hansen said. "In fact, the mayor was very vocally opposed to the NDP's housing legislation that allows 4 homes per lot, when in fact this is exactly what we need to do and encourage to help bring in the wealth."

Instead, the emphasis is on building new developments and expanding roads, which might not be a financially smart choice in the long term. Hansen argues this approach creates an "illusion of wealth" where the amount of money brought in from new development appears greater than it actually is in reality.

Councillor Kim Richter has been a vocal critic of the borrowing, calling the "half a billion dollars of new debt incurred by this Woodward-slate Council excessive." She and fellow councillor Margaret Kunst have pushed for more transparency around the township's debt load and repayment plans, but have been outvoted by the council majority.

The rapid pace of borrowing has also raised eyebrows for its departure from typical municipal practices. Most Fraser Valley municipalities save up development charges before building new amenities. Langley is instead borrowing against future fees, front-loading spending to build infrastructure faster.

This carries additional costs and risks. The township is relying heavily on temporary loans while waiting for long-term borrowing approvals - a practice finance director Sandra Ruff called a "last resort" due to higher interest rates.

There are also questions about democratic oversight. While residents technically had the opportunity to oppose the $75 million "strategic land" loan through an alternative approval process, they were given no information about what properties might be purchased. Only five people wrote letters opposing the borrowing.

As Langley Township continues its transformation from rural township to bustling suburb, the debate over its growth model is likely to intensify. Proponents argue the debt-fueled expansion is necessary to build a vibrant, livable community with ample amenities. Critics counter that it's a risky strategy that could saddle future generations with unsustainable costs.

What's clear is that the township's approach will be closely watched by other fast-growing municipalities grappling with similar challenges. As Hansen puts it: "The current approach is the same as what was done in Willoughby - try and build our way into financial prosperity with more growth, and the debt is just trying to get that payoff sooner. But it's a risky bet to make."

For now, construction cranes continue to dot the Langley skyline as thousands of new residents pour in each year. But beneath the boom times, serious questions linger about whether this model of growth can be sustained for the long haul.

Please let us know what you thought of this article!

Resources and References

This video was created by Township of Langley over 6 years ago, but provides very helpful general information about paying for municipal infrastructure that is still highly relevant

The Township of Langley Councillors vote on the Temporary Borrowing Bylaw (Strategic Land Loan), approving a $75 million loan to buy strategic land

Note: this article is almost a year old. It was published in March 2024, but is still highly relevant for this story.